GM Astar community! ![]()

It’s time to release the third Astar Finance Committee (AFC) Report, which covers the activities carried out by the AFC during part of September, October and beginning of November 2025.

As for the second report, also this report presents the new, simpler, and shorter format, avoiding the need to list the long series of on-chain activities carried out by AFC during the aforementioned period. The focus is instead placed on the most relevant sections of the report: Asset Allocation, Earned Amounts, Burned, Buy-Back & Burned and Coretime Reserve Amounts and Weekly Meetings Minutes. It is also important to highlight that all on-chain activities performed by AFC can be independently verified by anyone in a fully autonomous and permissionless manner, through the specific block explorers available for each network on which AFC operates (all details can be found in the final section of this report). Please note that the report format may undergo further changes and optimizations in the future, with the goal of providing the community with the best possible tool to monitor AFC’s activities. At the same time, it is intended not to be a mere formality, but a resource that can actively support AFC members in carrying out their work and help them make responsible and informed decisions.

Since its formation, the AFC has been actively working on the management of DAO allocation assets and the implementation of strategies aimed at fostering value creation, diversifying reserves, and deploying liquidity responsibly across ecosystems.

Asset Allocation

As of 5th November 2025, the assets managed by the AFC are allocated as follows (addresses with negligible balances are excluded from the report).

AFC Pure Proxy on Astar Network [SS58 (Substrate)]

Subscan (click for more details)

- 225M ASTR locked in dApp Staking

- 50M ASTR staked on OnFinality dApp

- 60M ASTR staked on Astar Safe dApp

- 70M ASTR staked on Community Treasury dApp

- 45M ASTR staked on Subscan dApp

- 15,090,885.2483 ASTR transferable amount

AFC Multisig 3/5 threshold [SS58 (Substrate)] on Hydration

Hydration App (click for more details)

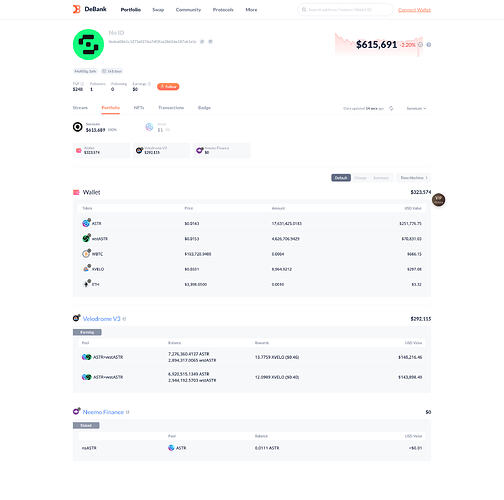

AFC Multisig 3/5 threshold [EVM] on Soneium

DeBank Dashboard (click for more details)

Earned Amounts

Since 19th September 2025 up to 5th November 2025, the amounts earned (mainly from dApp staking, liquidity provision and farming) are as follows:

- dApp Staking: 7,504,780.0583 ASTR —> as decided by AFC members, the burning of ASTR tokens is paused until more details will be available regarding Astar Burndrop mechanism. The idea behind this decision is to create a double-burn effect: instead of simply burning ASTR tokens, we can use the same amount of tokens to participate in Burndrop and use the received tokens to buy and burn ASTR again, that would effectively create a double(or even more, in case of multiple Burndrop events)-burn effect. Due to this decision, there will NOT be any burning of ASTR tokens this month.

- Hydration LP:

- vDOT farming: 3.2849 vDOT

- HDX farming: 585.3850 HDX

- GDOT farming: 8,139.7791 GDOT (about 9,125 GDOT sold for HUSDC)

- Velodrome LP:

- VELO farming: 13,516.9186 VELO (partially sold for USDC and then swapped some USDC for WBTC)

- Additional rewards, not directly quantifiable until the moment of redemption or swap of the liquid staking token, are represented by holding the tokens of liquid staking protocols: Bifrost (vASTR, vDOT) and Astake (wstASTR). These tokens appreciate over time relative to their underlying assets, as they continuously accumulate staking rewards.

Burned, Buy-Back & Burned and Coretime Reserve Amounts

Burned Amounts

- 887,284 ASTR (887,283 ASTR + 1 ASTR) on 18th July 2025 as announced in the 1st AFC report

- 4,700,788 ASTR on 24th September 2025 as announced in the 2nd AFC report

TOTAL ASTR burned by AFC since the start of its operations: 5,588,072 ASTR

Buy-Back & Burned Amounts

TBD

Coretime Reserve Amounts

- 5 DOT as test transaction to Astar sovereign account on the Coretime System Chain

- 295 DOT to Astar sovereign account on the Coretime System Chain for auto-renewal system (renewal failed due to UI/UX issues)

- 650 DOT (648 DOT + 2 DOT) to Startale Core Developer wallet on Polkadot to buy the new Coretime (it was manually purchased due to auto-renewal system fail)

TOTAL Coretime reserve amounts provided by AFC since the start of its operations: 950 DOT

Weekly Meetings Minutes

This section contains the minutes of the weekly meetings, summarizing the main topics discussed, decisions taken, and tasks assigned.

24th September 2025

- Performed on-chain operations in sync

- AFC members discussed how to allocate USDC amount on Soneium

- Mingshi Song suggested to deploy liquidity on Sake Finance, as Aave has too low yield on Soneium, or leveraging on SuperReturn

- Maarten Henskens suggested SuperReturn without leverage in order to avoid complexities

- AFC members discussed other possibilities such as buying ETH or BTC

- Mingshi Song will create a proposal vote for next investment: wBTC or ETH

- Luca Poggi proposed to explore buyback and burn strategy using GDOT and USDC

- Maarten Henskens highlighted buyback complexity by emphasizing transparent community communication and need to establish buyback strategy threshold

- Xin Xing Phua will investigate market makers onboarding process

- AFC members will schedule dedicated discussion next week and it was advised to wait before acting on small amount to avoid unnecessary steps

- Marcelo Alvarenga will create a proposal vote for supporting Subscan in dApp Staking, due to its recent listing

1st October 2025

- Performed on-chain operations in sync

- Guenael Wagner asked AFC members for feedback regarding Mimir multisig wallet, so he can report any requests to the team

- Guenael Wagner informed AFC members that some DOT token for next Coretime slot auction will be needed in a few months or beginning of next year

- Guenael Wagner took on the task of informing Subscan team regarding AFC dApp Staking actions

8th October 2025

- Performed on-chain operations in sync

- Mingshi Song proposed to increase liquidity for ASTR and vASTR on Hydration due to increased supply cap

- AFC members will discuss about this strategy in async

- Luca Poggi will create a proposal vote for this strategy

15th October 2025

- Performed on-chain operations in sync

- Guenael Wagner took on the task of drafting forum post about Coretime expenses

- AFC members discussed about the Hydration XCM rate limiter and Hydration pools limits

22th October 2025

- Performed on-chain operations in sync

- Luca Poggi proposed initiating a buyback and later burn program for Astar, starting with strategic purchases during market downturns to support the token’s price: he suggested using accumulated stablecoins to buy ASTR when its price drops by around 10%, aiming to stabilize the market, strengthen community confidence, and optimizing the amount of ASTR accumulated in preparation for future burns

- Xin Xing Phua suggested purchasing $20-30K tokens for meaningful market impact

- Legal team confirmed token purchases acceptable if not manipulating market

- Market makers indicate price impact likely occurs above 5% trading volume

- Maarten Henskens clarified market making strategies handled exclusively by Astar Foundation

- AFC members considered setting low-price buy orders to resist market drops

- Mingshi Song confirmed Binance corporate account registration process is straightforward

- Marcelo Alvarenga suggested postponing buyback program until more stablecoins are accumulated

- Maarten Henskens took on the task of creating a poll to initiate buyback program at specific stablecoin threshold

- Xin Xing Phua suggested purchasing $20-30K tokens for meaningful market impact

- Guenael Wagner announced that Coretime lease slot was successfully acquired and assigned to Astar Network without referendum

- Plan to enable auto-renewal of Coretime lease slot via governance referenda in early November 2025

29th October 2025

- Performed on-chain operations in sync

- Luca Poggi took on the task of preparing the 3rd AFC Monthly Report

- AFC members decided to reopen discussion about Buy-Back & Burn for ASTR when reaching 150k USD threshold in stablecoins

- AFC members decided to pause the ASTR Burn in order to evaluate the double-burn effect strategy (see above for details)

5th November 2025

- Performed on-chain operations in sync

- Luca Poggi took on the task of finalizing the 3rd AFC Monthly Report

- AFC members decided to move 20M ASTR from Community Treasury dApp to Subscan dApp

- Mingshi Song proposed to sell VELO tokens around upcoming Velodrome announcement next week

On-Chain Transparency

All on-chain activities performed by AFC can be verified by any member of the Astar community using the blockchain explorers relevant to the networks where the activities took place. Below, you will find the list of AFC’s addresses across the networks in which it has operated, along with the individual addresses of AFC members.

| Wallet Name | Public Key | Astar Network [SS58 (Substrate)] (*) | Astar Network [EVM] (*) | Soneium (*) | Hydration (*) | Bifrost Polkadot (*) |

|---|---|---|---|---|---|---|

| AFC Pure Proxy | 0x922ee694ea772dc63a575845fa57a0c5ea93dfdc2a93ec631d9e426962f1e311 |

ZEyDXf6563rc78ibEtYQAkHTSKLzMES1m2BrPNdLcma57Tg |

N.A. | N.A. | N.A. | N.A. |

| AFC Multisig 3/5 threshold [SS58 (Substrate)] | 0xb622b8b173b6016c7fcf66a9f392e2518313b09afb2a809fa1a69f9b6154f3a6 |

a47KfkpbXdvKP5jG1tk21kSgtyUCR81aLNokY9JaqFmE59F |

N.A. | N.A. | 157p2i3og5GHY64QjMVd8WRKTUFzvVyQddc9g7voGZHKpWNQ |

157p2i3og5GHY64QjMVd8WRKTUFzvVyQddc9g7voGZHKpWNQ |

| AFC Multisig 3/5 threshold [EVM] | 0xDEa0061c12756F276a7df2Faa3865de187AB1e5C |

N.A. | 0xDEa0061c12756F276a7df2Faa3865de187AB1e5C |

0xDEa0061c12756F276a7df2Faa3865de187AB1e5C |

N.A. | N.A. |

| Maarten Henskens - AFC [SS58] | 0xddbd373af7b1f2892a6ddb8e54095d32f6fc8c47852123e7d3220f5c05ddc833 |

ax35rmE4tKPzfn89aATn6iKxd8krQ73D5CDvmXmXPg8YBg2 |

N.A. | N.A. | 161jnu4D9RwmDNkocumLtbPCjCRHaUxSGNRZrMKGD7hh8pxt |

161jnu4D9RwmDNkocumLtbPCjCRHaUxSGNRZrMKGD7hh8pxt |

| Maarten Henskens - AFC [EVM] | 0xE04Ef470062B44A3256DfAC0a0484EEEBd23a6cE |

N.A. | 0xE04Ef470062B44A3256DfAC0a0484EEEBd23a6cE |

0xE04Ef470062B44A3256DfAC0a0484EEEBd23a6cE |

N.A. | N.A. |

| Xin Xing Phua - AFC [SS58] | 0x5801736120a0137e293b79762baf4bfca77071606c10e0477447b1a1f35ec3d1 |

XvgwMpewQg1P9brEihL8WW6nWphJ5WSMYjykhCCozic8kcN |

N.A. | N.A. | 12zPeQ7e1xJNbraXi4JDF1AyZ67E2AMqQqyKgGyhVikAjC9i |

12zPeQ7e1xJNbraXi4JDF1AyZ67E2AMqQqyKgGyhVikAjC9i |

| Xin Xing Phua - AFC [EVM] | 0x8FEd4fCAa019DC766A114eebEE6f3eB492ABbd7b |

N.A. | 0x8FEd4fCAa019DC766A114eebEE6f3eB492ABbd7b |

0x8FEd4fCAa019DC766A114eebEE6f3eB492ABbd7b |

N.A. | N.A. |

| Mingshi Song - AFC [SS58] | 0x6e77dc1016c3def627bd400d909e4489b8c033859bca60eee0748aa3da5e23e4 |

YS9AbgtyKa3LzaC2QnuNcskxKJoe885UAoVBZRQhoruHJMR |

N.A. | N.A. | 13Vqsdyt3sCQZhYsVkPnV7YditbLNCyUXU2q79CuPXtTscDN |

13Vqsdyt3sCQZhYsVkPnV7YditbLNCyUXU2q79CuPXtTscDN |

| Mingshi Song - AFC [EVM] | 0x13FCeA4B291007aCa3Cbb9aABC5D86E71F3d1F39 |

N.A. | 0x13FCeA4B291007aCa3Cbb9aABC5D86E71F3d1F39 |

0x13FCeA4B291007aCa3Cbb9aABC5D86E71F3d1F39 |

N.A. | N.A. |

| Marcelo Alvarenga - AFC [SS58] | 0x26aa2928aeb7f06f2f31c60b95f32ed50e929ab2beef099a08bc9e174c87ab34 |

WozfJRBDbCzRP7WusYMof1gXg528ArKtxbKxzfDjbE4qG5U |

N.A. | N.A. | 1shNLiAJ8qMe66CPD9Ev9gZJFMYrFhixFpftaSiRKFdRYHC |

1shNLiAJ8qMe66CPD9Ev9gZJFMYrFhixFpftaSiRKFdRYHC |

| Marcelo Alvarenga - AFC [EVM] | 0xECF25f90CaA80D3EFBED1932aCfDC5CC71437CC3 |

N.A. | 0xECF25f90CaA80D3EFBED1932aCfDC5CC71437CC3 |

0xECF25f90CaA80D3EFBED1932aCfDC5CC71437CC3 |

N.A. | N.A. |

| Luca Poggi - AFC [SS58] | 0xacf7cc49ceacddbbd81366ea0741caa3028f3325e8d84e9a80d47befa6bc0849 |

Zr697sT4oRht4rBdsK3wLDUXXYnJeGVLzMYxnrTDuy1x1tJ |

N.A. | N.A. | 14unrAAS9M456mps7Cuw3ptMJ6qK2j7tQHattNdwudzaYDkc |

14unrAAS9M456mps7Cuw3ptMJ6qK2j7tQHattNdwudzaYDkc |

| Luca Poggi - AFC [EVM] | 0x792Fb25c66eFcE66102eaE76A60d6ae05b568Ef2 |

N.A. | 0x792Fb25c66eFcE66102eaE76A60d6ae05b568Ef2 |

0x792Fb25c66eFcE66102eaE76A60d6ae05b568Ef2 |

N.A. | N.A. |

(*) Click on the address to open the corresponding block explorer

The Astar Finance Committee (AFC) is a dedicated governance body with the responsibility to manage the Astar Treasury assets assigned to it for generating sustainable revenue streams, accelerating ecosystem growth, and ensuring long-term value returns to the Astar ecosystem.

We encourage all Astar community members to review this monthly report. If you have questions, suggestions or want to get involved in any upcoming discussions, open a topic on the Astar Forum, tag us or drop a message in this discussion.

AFC members:

AFC observers:

—

Astar Finance Committee

November 2025