Summary

Starlay: Astar Native Lending Protocol

Lending Market

The lending share within the top 10 DeFi projects on major 7 public chains is analyzed on the spreadsheet below.

The Average: 30.60%

The Median: 25.83%

We aim to make Starlay Finance have 25% dominance on Astar at the end of 2022.

KGIs

30 Apr (2 months later from the release)

Starlay TVL: 100M

ArthSwap TVL: 200M

Astar TVL: 600M

(Starlay TVL):(ArthSwapTVL):(Astar TVL) = 1 : 2 : 6

End of 2022

Target TVL dominance: 25% (Median of the 7 representative chains)

Starlay TVL: 0.75B

ArthSwap TVL: 1B

Astar TVL: 3B

(Starlay TVL) : (ArthSwapTVL) : (Astar TVL) = 3 : 4 : 12

Schedule in 2022

14 Feb: Submit set of contracts to audit

22 Feb: Deploy to Astar mainnet

23 Feb: Publish the webfront

28 Feb: Financing $1M by using SAFT

1-3 Apr: IDO on ArthSwap

20 Apr: Distribute $LAY based on contributions

30 Apr: Release the feature of staking $LAY

30 May: Minor improvements raised from the community

Product Features

Smart Contract (forked from AAVE V2)

- Depositing / Borrowing

- 25 Feb: $ASTR / $WETH / $WBTC / $USDC / $USDT / $WSDN

- 30 Apr: $ARSW / $LAY

- Flashloan for developers

- Not displayed on UI

- Fetching price data from Chainlink (that will be supposed to be released)

- $LAY staking

Backend (from scratch)

- Building a cashing server to calculate rates for UI

- based on GKE (GCP)

Frontend (from scratch)

- Only the variable borrow rate on UI

- Stable Borrow will not be supported

- Deposit Swap will not be supported on UI

- MetaMask support only

- Desktop support only

UI / UX

- Compound based UI

- Astar-ish color and design

Tokenomics

Ticker: $LAY

Decimal: 18

Total Supply: 1,000,000,000

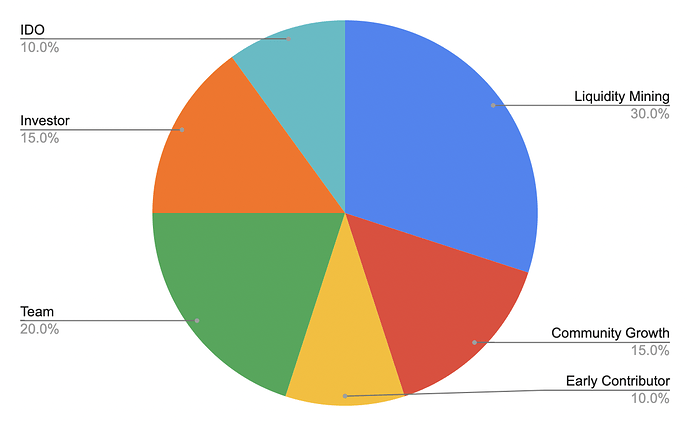

Distribution

Emission

Except for IDO, the tokens will be rewarded gradually.

Liquidity Mining

Deposit Incentive: 30% of Liquidity Minging Emission

Withdraw Incentive: 70% of Liquidity Minging Emission

Incentive Weight

Stablecoins and the native token should be incentivized larger than others.

- $ASTR: 3x

- $USDT: 3x

- $USDC: 3x

- $WETH: 2x

- $WBTC: 2x

- $SDN: 1x

- $ARSW: 1x

APR

Since it is useless to calculate APR on analysis, we should calculate the emission amounts for each token on both the depositor side and the borrower side. The details are described on the sheet.

Protocol Revenue

Borrow Interest

Calculated with the same way as AAVE does

(Borrow Interest) - {Deposit APR without $LAY incentives)} ≒ 1%

Liquidation

Example:

Bob deposits 10 ASTR and borrows 5 ASTR worth of USDC.

If Bob’s Health Factor drops below 1 his loan will be eligible for liquidation.

A liquidator can repay up to 50% of a single borrowed amount = 2.5 ASTR worth of USDC.

In return, the liquidator can claim single collateral which is ASTR (5% bonus).

The liquidator claims 2.5 + 0.125 ASTR for repaying 2.5 ASTR worth of USDC.

Depositing & Earning

Basically, the earning system would be inherited from AAVE.

vToken, which is an original IOU, holders receive continuous earnings that evolve with market conditions based on:

- The interest rate payment on loans - depositors share the interests paid by borrowers corresponding to the average borrow rate times the utilization rate. The higher the utilization of a reserve the higher the yield for depositors.

- Flash Loan fees - depositors receive a share of the Flash Loan fees corresponding to 0.09% of the Flash Loan volume.