Background

The dApps rewards were originally created to reward dApps developers; we were thinking of a reward structure that would do something like M&A using a trading module. However, based on the trajectory of dApps on Ethereum in 2020, it became clear that selling ERC20 tokens to dApps developers would be a viable business. In addition, the use of tokens to design rewards for users has solved the problem of liquidity and created the DeFi bubble. However, there is one problem with all of this. Just as tokens on Ethereum will not exceed the market cap of ETH, tokens on Plasm Network will not exceed the market cap of PLM. To achieve a sustainable reward design under such circumstances, we propose a new way to use dApps rewards and optimize the variables.

How to use

Up until now, we have been able to specify the recipients of dApps rewards. From now on, the recipient of dApps rewards will be only the contract address. And the contract should be an ERC20 token if you will. Then, let’s say you distribute the PLMs you received as rewards to the token holders. Let’s say the name of this token is “MINAZUM” (MNM).

The MNM token is paid to the liquidity provider. By staking MNM tokens, the PLMs held in the MNM token contract can be claimed with a proportional dividend. In this way, we can design sustainable developer/liquidity provider rewards for dApps on the Plasm Network.

Improvement Inflation rate

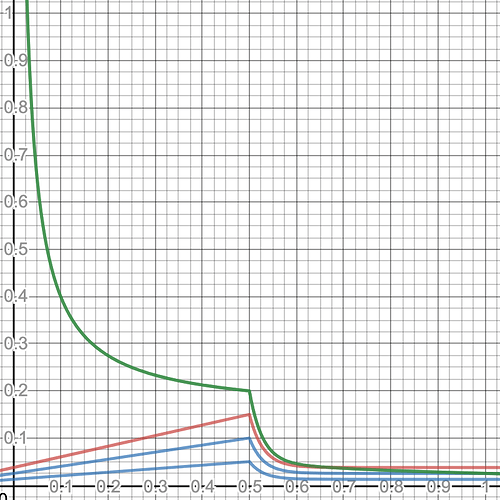

Therefore, the inflation model defined in the current dApps rewards can be improved as follows

- The security of Plasm Network depends on Polkadot after it becomes Parachain. Therefore, reduce the rewards for security.

- Adjust dApps Staking so that the nominator’s reward is always higher than the inflation rate.

The following are some of the parameters that we will design.

See here for a description of the existing dApps rewards and the names of the parameters.

Modify some parameters of the formula described here.

The numbers mean:

Ideally, 25% of PLM is used for Staking to Collator and 25% is used for Staking to Contract. The remaining 50% will be used as liquidity tokens. At this time, Staker gets an average annual yield of 20%. The maximum inflation rate will be 15%. 5% of the total Inflation rate is paid to the dApps reward.

Considering

For example, at this time, it is assumed that 20% of the total PLM is used to supply liquidity to DeFi. dapps reward If 80% of the reward is distributed to users, 5% * 80% = 4% will be allocated to 30% of Staking. Then, the APY of DeFi liquidity provider is about 4% / 20% = 20%.

Considering the TVL base of Etheruem, the sum of the TVLs of DeFi on all Ethereum seems to be about 1/2 to 1/4 of the market capitalization of ETH. (https://defipulse.com/) If 50% of PLM’s assets are managed by DeFi on PLM, 4% / 50% = 8% will be paid as additional compensation. Of course, the profit of DeFi is not only from PLM distribution but also from Fee, so APY 8% + commission income is expected. (10% + seems to be stable)

Future works

Because it is

q=\frac{Staking_{validators}}{Staking_{validator}+Staking_{contracts}}

Thereby, if q > 0.5

If q < 0.5

In the equation, we should be able to make adjustments.