Welcome to SAKE FINANCE ![]()

![]()

Thank you for the information. Each detail is quite interesting. I would like to ask further about the current market conditions. It’s understood that liquidity in the crypto market has been decreasing compared to before. What opportunities or challenges does the team see in this regard? This might impact the project to some extent. =)

Do you mind sharing some more economical data on protocol level?

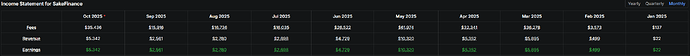

Attached you can see the income statement i gathered from defillama. Is this data correct or do you have different internal numbers?

Granted these numbers are correct or at least have a low deviation, it becomes quite obvious that this state is not securing a selfsustaining protocol. Given revenenue usually != earnings. Whats the fixcosts you are facing to operate on a monthly basis, if you dont mind share this data?

Regarding TGE i defnitely share that the lack of informations you provided and clear path forward is slightly unsatisfying, but i also share your take of releasing another gov token wont help for the better. So i am excited to hear more about that as i think there are quite some things you can do to make the token useful and learn from mistakes the likes of $UNI for example did.

This changes nothing regarding my support for the protocol. Its just some questions that came to my mind. As i truely think you did a lot of things right, especially given the recent hack that also affected you in various ways.

Good question

This (liquidity in the crypto market) might impact the project to some extent. =)

Quite the understatement.

The top opportunity that the team has been pushing on is the looping of LSTs and other yield bearing assets against their non yield bearing counterparts. This is a relatively low risk strategy that can be used easily to multiply the yield earned.

We’ve seen traction in a number of pairs

- SolvBTCJUP-SolvBTC

- xSolvBTC-SolvBTC

- wstASTR-ASTR

- nsASTR-ASTR (pre exploit)

- sSuperUSD-USDC

Notably lacking is ETH correlated pairs. We listed pufETH a while ago but have yet to see any significant traction on Soneium. wstETH didn’t have early traction but has has recently gained some momentum and could be a good candidate for this, possibly yaySTONE. More to be explored in this area.

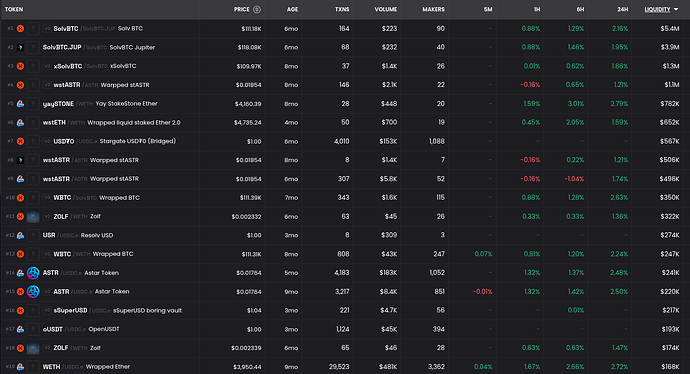

One challenge that we face is in the issue of dex liquidity on Soneium. While many of the pools are sufficiently deep, we see that the top 10 deepest pools and 14 of the top 20 deepest pools are between correlated pairs.

Source https://dexscreener.com/soneium?rankBy=liquidity&order=desc

The problem with this is that dex liquidity impacts the ability of liquidators to effectively liquidate unhealthy positions, and correlated pairs are rarely liquidated in lending protocols. It’s the uncorrelated pairs that need to be liquidated during periods of high market volatility.

One positive note is that liquidation is permissionless and we have seen a number of third parties run liquidator bots, even beating our own in-house liquidator bot on many occasions. This is a net positive for the protocol as it helps to maintain its health. These other liquidators may be able to tap into other sources of liquidity, either their own funds or routes that we haven’t picked up on.

We could improve on this situation by swapping in pools on other chains, though at the moment this requires some additional engineering, upfront capital, and timing risk. Superchain interop will be a huge unlock in this regard, the theory being it allows for multichain atomic transactions such as liquidate on one chain and swap on another. Alas, we’re still waiting on this upgrade, so we’ll have to work with what we have.

Hope this answers your questions

Hi @PolkaWarrior,

Do you mind sharing some more economical data on protocol level?

Those numbers from defillama are correct for the most part. Minor note, revenue is collected in multiple tokens, which I believe defillama converts to USD at the given timestamp, though the relative value of our holdings fluxuates over time.

With that in mind, the analysis is still the same: the Sake protocol does not generate enough revenue to pay the salaries of a team of 8. We are looking into ways to boost these numbers, but to do so in a fair way and not gouge our users.

Luckily our infra costs are low and we have funding so we’ll continue building and operating for the foreseeable future. One goal is to make the protocol self-sustaining so we won’t need any more funding, though as the numbers show it will take some effort to get there.

Regarding TGE

That’s fair. There is demand from the community for a token, and we should put more time and thought into TGE. The team has been focused on building things that we believe are more value-adding than a token could be, but the power of a token can go a long way.

Do you have any tokens or token models that you particularly like or dislike? Free to discuss either here or in DMs.

my support for the protocol