I’ve used NotebookLM to help me synthesize the key points from our recent discussion: [Astar Forum Link].

I did this to ensure the summary is as clear and objective as possible, as I believe a truly open conversation about our dApp model is long overdue, given four years of results.

What are the real issues with our current dApp Staking model?

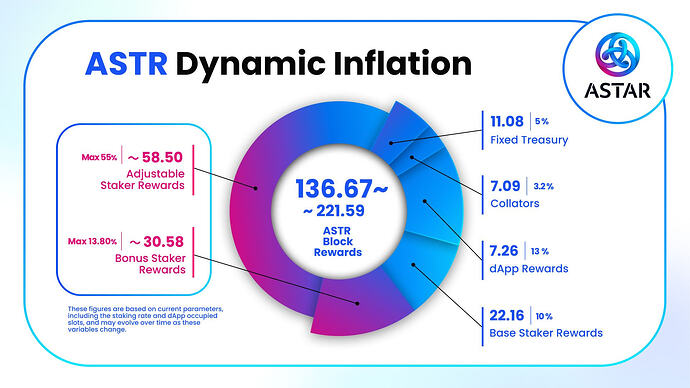

- Runaway Inflation: The system has essentially turned into an inflation machine. It’s minting tokens without creating the proportional economic value the network needs to thrive. Simply put, dApp Staking isn’t driving the growth we all expected.

- The “Free-Loader” Problem: We’re seeing too many “parasitic” projects or half-baked developments. These entities extract economic value—taking ASTR tokens from staking rewards—without giving anything back to the ecosystem in terms of innovation or tangible contributions.

- A Lack of Leader Projects: Despite having many participants, we’re missing that “flagship” project—a real spearhead capable of leading the network toward true market relevance and adoption.

- Too Much Optimism, Not Enough Filtering: Initially, we may have been overly optimistic. Our selection filters weren’t rigorous enough, which let low-quality projects in and eventually forced the Community Council to step in with painful delistings.

- Building on Uncertainty: The current model creates a risky economic dependency. We’re essentially operating on the “hope” that hosted projects will eventually provide value. When that return doesn’t happen, it creates a wave of uncertainty that hurts both our markets and our ecosystem’s stability.

- The Bottom Line: I still believe the core idea behind dApp Staking is a “gem,” but our current methods have hit a breaking point. We need a 180-degree turn to make this network economically sustainable.

An Analogy to Think About:

Imagine dApp Staking as a massive scholarship program where students keep collecting funds without ever graduating or producing useful research. The school keeps printing money to pay them, but because the actual “knowledge” (economic value) isn’t growing, the entire institution faces financial collapse.

How do we fix the dApp model?

The proposals on the table suggest a total shift in direction: transforming Astar from just a dApp infrastructure into a living, breathing Economic Hub. Here’s the breakdown:

-

Becoming an “Economic Financial Hub”: Astar needs to evolve. We should create a “Star Product” dApp that serves as the ecosystem’s centerpiece, hosting both traditional and innovative financial tools in one seamless interface.

-

Massive Stablecoin Integration (USDSC): We need to leverage USDSC to capture fresh liquidity from both institutions and everyday users. This would allow for ASTR trading pairs that actually stabilize and attract people to the network.

-

Diversifying our Financial Tools: This Hub should offer interconnected services through vaults and liquidity pools, including:

-

Lending and Borrowing.

-

Savings and Farming tools.

-

Rapid Swaps and Commodity markets.

-

Third-party Asset Management (AUM).

-

-

A Radical Reform of dApp Staking: Instead of an isolated system that just pumps out inflation, dApp Staking would become a core part of the Hub. Crucially, builders would no longer be rewarded with just new ASTR tokens, but with USDSC liquidity generated from real Hub revenue (like lending fees).

-

A Hybrid Governance Model: We’re looking at a two-pronged approach:

-

Centralized: For quick technical calls, financial alliances, and yield strategies.

-

Decentralized: For community voting, managing collective funds, and implementing tech like Account Abstraction.

-

-

“Buy-back and Burn” Mechanism: A major proposal involves using 70% of the Hub’s revenue (the portion not going to staking) to buy back and burn ASTR tokens. This creates the deflationary pressure we need to support the token’s value.

-

Smart Contract Automation: All of this—capital distribution and governance—should be handled by Solidity smart contracts to ensure transparency and automatic monthly triggers based on actual earnings.

An Analogy to Think About:

We’re trying to move Astar from being a “small town that prints its own money” to pay for public works (causing inflation) to a “Financial Holding Company” that manages profitable businesses. In this new world, the public works (dApp projects) are paid for by the holding company’s actual profits, keeping the local currency strong and in high demand.

How would “Lending” revenue support our projects?

Lending revenue would become the financial engine for hosted projects. By reinvesting direct liquidity, we move away from an inflationary system and toward one based on real-world profits.

-

Revenue Allocation: The proposal suggests taking 30% of the monthly income, specifically from lending and injecting it into dApp Staking. The other 70% stays in the Hub to keep things running and support the ASTR token through buy-backs.

-

The Power of Stablecoins (USDSC): Unlike the current model, support would be paid out in USDSC. This is a game-changer because it gives builders stable, real liquidity to fund their work while protecting the ASTR token from constant sell pressure.

-

Fair Distribution: Imagine $1 million in revenue; $300,000 would be split among, say, 50 projects. This could be an equal split (giving everyone $6,000) or based on performance metrics like TVL (Total Value Locked) or community votes.

-

Transparency and Resilience: Because this is automated via smart contracts, it’s transparent and reliable. This makes the entire ecosystem more resilient; the survival of a project no longer depends on “hope,” but on a steady cash flow generated by the Hub’s financial activity.

An Analogy to Think About:

Think of it like a massive shopping mall (the Economic Hub). The mall decides to take 30% of the rent paid by established shops (the lending revenue) to directly fund innovative startups that set up kiosks inside (the hosted projects). Instead of giving these startups “store coupons” that lose value (ASTR inflation), the mall pays them in cold, hard cash (USDSC). This gives them stability and makes the mall a magnet for new talent.