Hello Astar and Soneium Community,

As Amil Gaoul, founder of SoneVibe a native DeFi platform building on Astar and Soneium I am excited to open this dedicated thread for ongoing progress updates, milestone reports, and open community feedback.

SoneVibe is committed to driving real utility, TVL, and user friendly experiences across the ecosystem. We launched early on Soneium to capture the massive potential of Sony backed mass adoption (gaming, entertainment, automotive), while maintaining strong roots in Astar EVM for seamless cross-chain value.

Our vision: Become the go-to fortress DeFi hub with sustainable, organic real yield no farmed emissions, pure fees from actual usage.

Recent Milestones & Updates (January 2026):

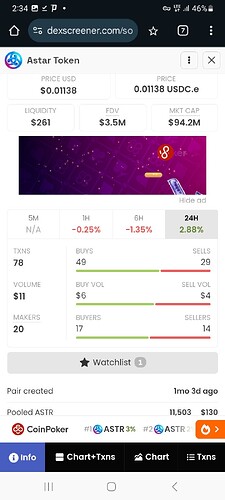

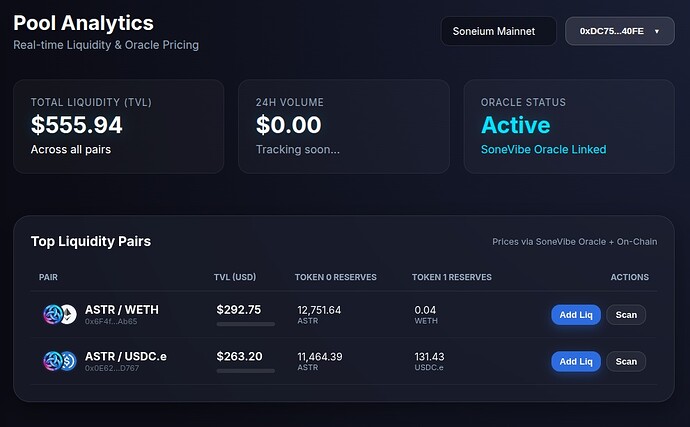

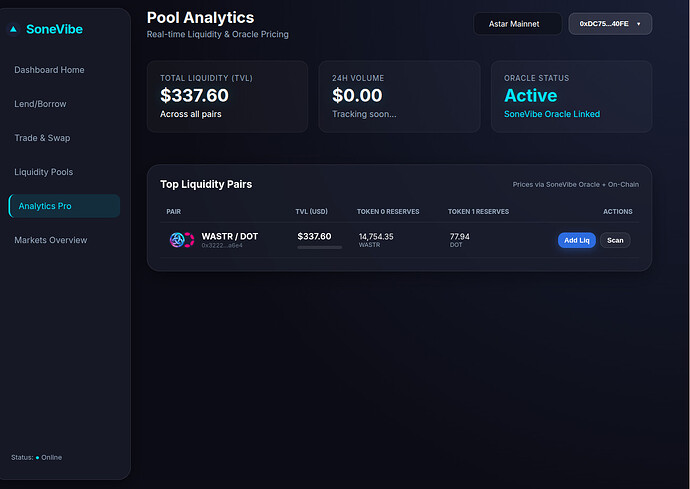

1. Blue-Chip Pools Live on Soneium & Astar Mainnet

- New pairs: WETH/ASTR, USDC/ASTR, DOT/ASTR.

- Low initial TVL (~$260-310) means massive early APR opportunities (estimated 15-40%+ as volume scales organically).

- All pairs powered by resilient oracles with on-chain fallback for maximum security.

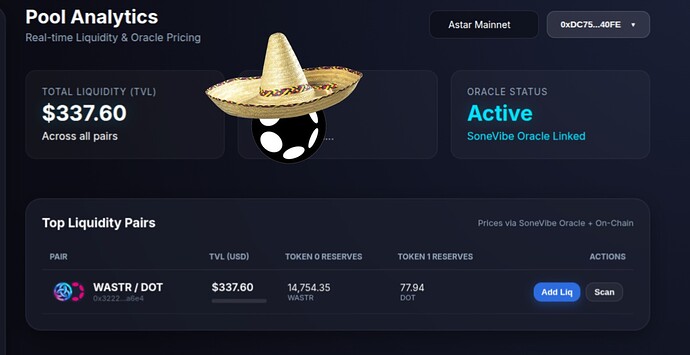

2. MVP Analytics Dashboard Launched

-

Live tracking for all pools: Prices, liquidity, volume, and oracle health.

-

Direct link: SoneVibe | Analytics Pro

-

Transparent and user-focused – monitor your positions in real time.

3. Full Wallet Compatibility

-

Seamless support for MetaMask, Trust Wallet (mobile), and Nova Wallet.

-

No friction for Astar/Soneium users.

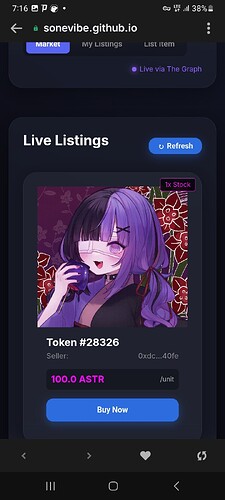

4. Marketplace Growth: Astar Degens Listings

-

Direct, seamless access to high-potential Degens NFTs.

-

Native wrap/unwrap ASTR to wASTR via built-in Swap – no external bridges, low fees, fast.

-

Growing listings as indexing stabilizes (SubQuery, Graph, OnFinality integrations live).

5. Core Features Driving Utility

-

Swap: Blue-chip and emerging pairs with competitive fees.

-

Lending/Borrowing: Secure markets for real yield farming.

- All sustainable: Fees flow to LPs and treasury – pure organic growth.

Community Feedback & Early Traction

- TG channel buzzing: Users asking for direct Degens access, wrap guides, and pair suggestions – live support always available: Telegram: View @SoneVibe

- Organic transactions: 35+ daily arbitrage/txns already, even at low TVL.

- We’re hiring: Builders welcome to contribute to the roadmap.

This thread will serve as our regular update hub: Monthly/weekly reports on TVL growth, new pairs/integrations, security audits, and ecosystem contributions. I invite all holders, stakers, builders, and community members to share feedback, suggestions, or questions here.

How can SoneVibe better serve Astar/Soneium users? What pairs or features next? Let’s build together.

Looking forward to your thoughts!

Amil Gaoul

Founder, SoneVibe

DeFi fortress on Astar & Soneium