Hello Astar community — I’m Max from the Comet Swap team.

This is Comet Swap’s first public post, as we approach two key milestones:

-

Shibuya testnet — January 2026

-

Astar EVM mainnet — Q1 2026

We’re excited to share our design and direction to invite early feedback and clarify how Comet Swap is built to strengthen Astar — not just as an infrastructure, but as a liquidity-efficient, ASTR-anchored protocol that routes protocol-generated value back to the Astar ecosystem.

-

TL;DR

-

Astar-native CLMM DEX with high liquidity efficiency

-

ASTR is the core asset - no new token extracting value from the ecosystem

-

100% of net protocol fees → ASTR buybacks → Boost for ASTR stakers

-

I. What is Comet Swap?

Comet Swap is a Concentrated Liquidity Market Maker (CLMM) DEX, built natively on Astar EVM with native dApp staking support and ASTR-alignment, aiming for liquidity efficiency and smooth trading experience.

What is CLMM?

CLMM differs from vanilla AMMs in one key way: liquidity is not spread across the entire price curve. Instead, LPs can concentrate liquidity into selected price ranges where trading is most active. This can significantly improve liquidity efficiency.

What Comet Swap CLMM brings

For Traders

-

Lower slippage / better execution: usable liquidity is deeper near the active price, reducing price impact for typical swaps.

-

More effective depth per TVL: the same TVL can provide stronger usable depth where trading actually occurs.

-

Smooth trading experience: fast, simple swaps with a clean UX and clear execution.

For LPs

-

Higher liquidity efficiency: provide liquidity in custom ranges instead of across the full curve.

-

More advanced position management: positions are LP NFTs that make your range, liquidity, and accrued fees explicit—simple to track and adjust.

II. What makes Comet Swap different?

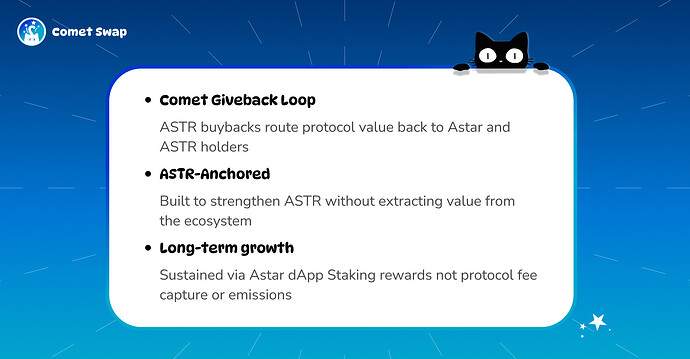

Comet Swap is being built with a clear progression of goals: community alignment → non-extractive growth → long-term operations. The thesis is simple: strengthen ASTR and the Astar staking economy, rather than diluting attention or extracting value away from the ecosystem.

With no new token launches, we don’t rely on emissions-led growth. Instead, we focus on ASTR-first incentives and fund sustainable development through Astar dApp Staking—while keeping the giveback loop intact.

Comet Giveback Loop

The core economic mechanism is simple and transparent:

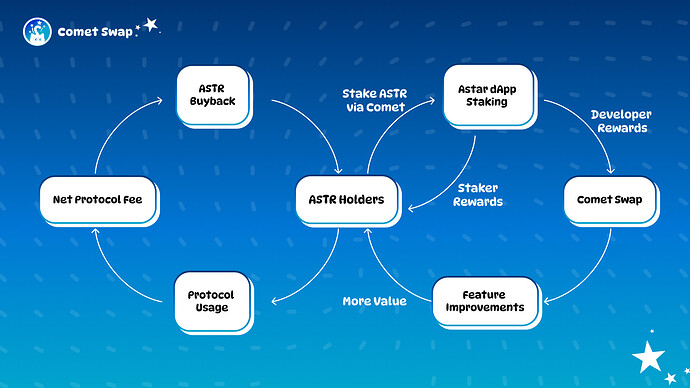

Protocol usage → net protocol fees → ASTR buyback → Boost distributed to ASTR stakers

-

100% of net protocol fees are used for periodic ASTR buybacks

-

100% of bought-back ASTR is distributed to ASTR stakers as Boost

There is no direct fee capture by the team. More importantly, Boost is usage-backed: it’s funded by real protocol activity, not by introducing a new incentive asset or emissions program whose primary purpose is to bootstrap growth by redirecting liquidity into a separate token market—extracting value from the ecosystem and fragmenting attention.

Comet Swap is designed so value created by trading activity flows directly back into Astar ecosystem, especially to long-term ASTR holders who support the network by staking.

How to participate: ASTR holders stake via the Comet interface and receive Astar dApp Staking rewards (APR), while Boost provides incremental, usage-backed distribution via the Comet Giveback Loop.

ASTR-anchored Alignment

Astar’s culture has always been builder-first and community-first — from dApp Staking’s long-running support for builders, to the constant community discussion on the forum. That culture is exactly what makes Astar feel different — and it’s a big reason we’re here.

We have strong conviction in Astar’s long-term direction. As ASTR sits at the economic center of that story, our commitment is simple: we build around ASTR, and we keep value flowing back into Astar.

-

ASTR is the anchor — staking and incentives stay ASTR-anchored

-

Boost is usage-backed — buybacks come from real trading activity, creating a healthy, sustainable value loop for ASTR (not short-term incentive noise)

-

Boost goes to ASTR stakers — strengthening long-term staking incentives and supporting the broader Astar economy

This keeps incentives focused on Astar and ASTR. Comet Swap is meant to grow with the ecosystem and give back to the people who support it.

Long-term Growth

The protocol also needs a way to fund long-term development and growth. Instead of extracting from protocol fees, Comet Swap earns rewards via Astar’s dApp Staking, just like other supported dApps.

This supports:

-

Engineering & maintenance

-

Performance & UX improvements

-

Ecosystem integrations

-

Security monitoring & infrastructure upkeep

More users staking ASTR via Comet Swap → more dApp Staking rewards to users and the protocol → stronger incentives + long-term sustainability

Users earn dApp Staking APR + Boost, while the protocol receives dApp Staking rewards to keep shipping long-term — a win-win alignment that preserves the Giveback Loop.

III. Why this matters

As Astar enters its next growth phase — with expanded adoption in the Soneium ecosystem, Startale App rollout, tokenomics 3.0 progressing, and ongoing Burndrop experiment — it’s increasingly important that DeFi protocols reinforce ASTR, rather than extract value from it.

For the Astar ecosystem

-

More ASTR aligned with long-term staking

Boost strengthens the incentive to stake ASTR, supporting participation in Astar’s staking economy.

-

A clear value loop back to ASTR

Protocol usage → Fee generation → ASTR buyback → Distribution to stakers

For ASTR users

-

Liquidity-efficient markets through CLMM liquidity design

-

Clear yield sources: dApp staking rewards + usage-based Boost

-

Long-term alignment: returns scale with adoption, not short-term emissions

IV. Team and Mascot

Comet Swap is built by a team of 11 cat lovers with experience across DeFi, tech and art, with joint effort and support from Astar Foundation.

Astar Foundation and our team’s focus is dedicated to build ecosystem-aligned, collective-first DeFi infrastructure designed for long-term sustainability of Astar ecosystem.

Comet Cat is our Mascot and hope you like it.

V. Roadmap

-

Internal validation (in progress)

-

End-to-end testing for swaps, CLMM positions, and fee accounting

-

Staking flow validation and security review cycles

-

-

Shibuya testnet — Target: January 2026

- Community testing and UX feedback

-

Astar EVM mainnet — Target: Q1 2026

-

Mainnet launch: core swap + CLMM liquidity live

-

Post-launch iteration on UX, liquidity tooling, and performance

-

-

Comet Giveback Loop (Boost) — Separate milestone

-

Activate the protocol fee → ASTR buyback → Boost distribution loop

-

Tune buyback cadence based on real usage

-

-

Ecosystem integrations (planned)

- Planned integrations with Astar ecosystem entry points such as the Astar Portal and other user-friendly frontends, enabling faster and smoother access to Comet Swap

VI. Summary

Comet Swap is an Astar-native CLMM DEX built to strengthen ASTR and route value back to the community.

It is designed to:

-

Improve liquidity and execution through CLMM design

-

Give value back to ASTR stakers through a clear ASTR buyback mechanism

-

Sustain long-term development through Astar dApp Staking rewards, not protocol fee extraction

We’re excited to share progress as we approach Shibuya testnet and mainnet milestones. Questions on mechanism design, fee policy, or implementation approach are welcome — happy to clarify in the replies.

VII. Resources

-

Twitter: https://x.com/Comet_Swap

![Nyan Cat! [Official]](https://us1.discourse-cdn.com/flex020/uploads/plasmnet/original/2X/b/ba17e93a9e65fe95660f9603bf30784033be1443.jpeg)